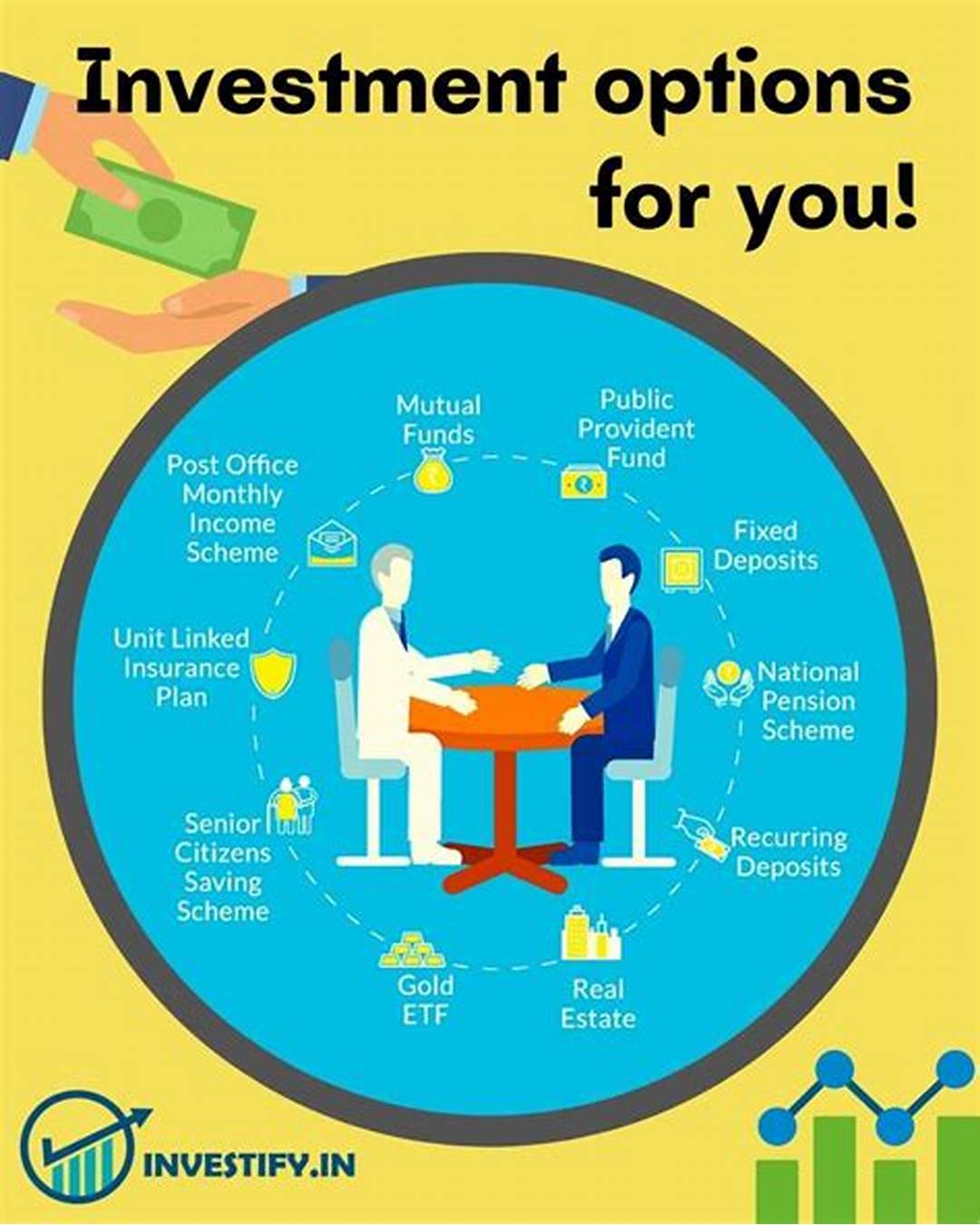

Here are the Top 10 Investment Options in India in 2025, based on risk appetite, return potential, and popularity:

🔒 1. Mutual Funds (SIP & Lump Sum)মিউচুৱেল ফাণ্ডছ (ছিপ & লাম্প চাম)

- Type: Market-linked/প্ৰকাৰ: বজাৰ-সংযুক্ত

- Returns: 10–15% (equity), 6–9% (debt)/পুনৰুদ্ধাৰ: ১০–১৫% (অংশৱিহাৰ), ৬–৯% (ঋণ)

- Best For: Long-term wealth creation/শ্ৰেষ্ঠ বাবে: দীঘলীয়া সময়ৰ বাবে ধন সৃষ্টিৰ বাবে

- Risk: Moderate to High/জোখম: মাজলীলৈ উচ্চ

- Popular Choices: Axis Bluechip Fund, HDFC Flexi Cap, SBI Small Cap/জনপ্ৰিয় বিকল্প: এচিছ ব্লুচিপ ফাণ্ড, এইচডিএফচি ফ্লেক্সি কেপ, এছবিআই স্মল কেপ

🏦 2. Fixed Deposits (Bank & Corporate)

- Type: Fixed income

- Returns: 6–8%

- Best For: Capital protection and guaranteed returns

- Risk: Very Low

- Note: Some small finance banks offer >8% FD rates in 2025

📈 3. Stock Market (Direct Equity)

- Type: Market-linked

- Returns: High (if done right)

- Best For: Experienced investors or traders

- Risk: High

- Tip: Invest in blue-chip or dividend-yielding stocks

🪙 4. Gold (Digital, Physical, or Sovereign Gold Bonds)

- Type: Commodity-based

- Returns: 7–10%

- Best For: Hedge against inflation and economic uncertainty

- Risk: Low to Medium

- SGBs: Tax-free after 8 years

🧾 5. Public Provident Fund (PPF)

- Type: Government-backed

- Returns: ~7.1% (tax-free)

- Best For: Long-term tax-free retirement corpus

- Risk: Very Low

- Lock-in: 15 years

🏘️ 6. Real Estate (Residential & Commercial)

- Type: Physical asset

- Returns: 8–15% (with appreciation + rental yield)

- Best For: Long-term wealth and passive income

- Risk: Medium

- Note: REITs also available as alternatives

💼 7. National Pension System (NPS)

- Type: Retirement-focused, partly equity-linked

- Returns: 8–10%

- Best For: Retirement planning with tax benefits

- Risk: Low to Medium

- Tax Benefit: Up to ₹50,000 under Sec 80CCD(1B)

💸 8. Monthly Income Schemes (Post Office MIS, Senior Citizen Savings Scheme)

- Type: Fixed income

- Returns: 7–8.5%

- Best For: Retirees or fixed monthly income

- Risk: Low

- Tenure: 5 years

🏠 9. Real Estate Investment Trusts (REITs)

- Type: Market-traded real estate

- Returns: 6–12%

- Best For: Passive real estate exposure without ownership

- Risk: Medium

🌱 10. Startups & Alternative Investments (via AIFs, Crowdfunding, or Angel Investing)

- Type: High-risk, high-reward

- Returns: 15–30% (if successful)

- Best For: High net-worth individuals (HNIs)

- Risk: Very High

- Note: Research and diversification are key